does colorado have a solar tax credit

Ad Find The Best Solar Providers In Colorado. Save time and file online.

The Extended 26 Solar Tax Credit Critical Factors To Know

The program had enjoyed a considerable measure of success though so lawmakers granted a series of extensions that promised to keep the program alive until the end of 2016.

. Xcel Energy offers the top utility net metering program in Colorado. Colorado state sales tax exemption for solar power systems though the state tax credit is no longer an option for colorado customers solar power systems are exempt from related sales and use taxes. Enter Your Zip See If You Qualify.

In 2004 Colorado passed a ballot initiative creating a state-wide Renewable Energy Portfolio Standard RPS that has paved the way for the expansion of the Colorado solar industry. The place of installation must be owned by the Colorado Springs Utilities electric customer or in the case of new construction under the customers name. The income tax credit is.

However the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own though it may be eligible for the business ITC under IRC Section 48. Does Colorado Have A Solar Tax Credit - Not only does the state get more than 300 days of sunshine per year but there are also several colorado solar incentives including rebates and tax credits to help you cover the costs. You can take the total cost of your solar system installation and apply 30 to your tax liability for the year.

What You Need to Know. Colorado does not offer state. The tax credit helps business owners develop passive income and utility reductions quickly.

Ad Enter Your Zip Code - Get Qualified Instantly. 026 18000 4680 State Tax Credit. You may use the Departments free e-file service Revenue Online to file your state income tax.

For example if your solar PV system was installed before December 31 2022 installation costs totaled 18000 and your state government gave you a one-time rebate of 1000 for installing the system your federal tax credit would be calculated as follows. Depending on the installation up to 40 of your system costs could be covered by rebates and tax credits. You do not need to login to Revenue Online to File a Return.

This perk is commonly known as the ITC short for Investment Tax Credit. Federal solar investment tax credit. Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle.

You can claim the credit for your primary residence vacation home and for either an existing structure or new construction. Colorado easily has some of the strongest support in the nation for renewable energy. The main tax incentive offered by the federal government is known as the solar investment tax credit ITC for businesses or the residential renewable energy tax credit for households.

The 26 federal tax credit is available for purchased home solar systems installed by december 31 2022. In either case the federal tax credit allows you to reduce your income taxes owed by up to 30 of the total cost of a solar system installation. Check Rebates Incentives.

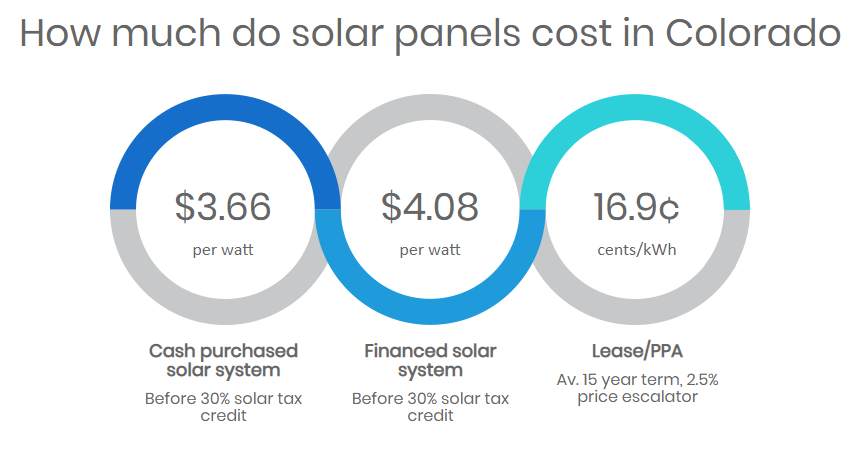

The federal solar tax credit is the most popular financial incentive for homeowners looking to go solar. 6 Approximate average-sized 5-kilowatt kW system cost in Colorado. Colorado Solar Rebates Incentives and Tax Credits Colorado is definitely one of the more progressive states out there when it comes to renewable energy generation.

7 hours agoThe US. See Ratings Compare. One reason for this might be that there are many rebates and grants elsewhere through local governments and utility companies.

The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Colorado. The Energy Improvement and Extension Act of 2008 extended the tax credit to small wind-energy systems and geothermal heat pumps effective January 1 2008. The federal solar tax credit.

Some dealers offer this at point of sale. Dont forget about federal solar incentives. With the Investment Tax Credit ITC you can reduce the cost of your PV solar energy system by 26 percent.

Colorado Solar Power Performance Payments Performance-Based Incentives. Enter Your Zip Find Out How Much You Might Save. Keep in mind that the ITC applies only to those who buy their PV system outright either with a cash purchase or solar loan and that.

When it is time to file your taxes complete Form 5965 IRS Federal Tax Credit Form. After you file you have the option of setting up a Login ID and Password to view your income tax account in Revenue Online. The 26 tax credit is a dollar-for-dollar reduction of the income tax you owe.

While the State of Colorado no longer offers tax credits for residential solar the federal government still provides a 30 Investment Tax Credit for home solar power systems. 720 is lost due to a 16 percent tax credit for the year 2020. Obtaining an investment tax credit for the installation of solar panels is a simple process.

12720 Approximate system cost in Colorado after the 26 ITC in 2021. Some states have state. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income.

Colorados Solar Friendly Communities is an offshoot of the national Sunshot Initiative that has resulted in several municipalities and county governments developing streamlined application and approval processes. Buy and install new solar panels in Colorado in 2021 with or without battery storage and qualify for the 26 federal solar tax credit. The residential ITC drops to 22 in 2023 and ends in 2024.

The credits decrease every few years from 2500 during January 2021 2023 to 2000. Due to 4000 in taxes your tax bill would no longer be canceled. While Colorado is a leader in solar energy the state itself does not offer any tax credit on solar energy.

Solar Tax Credit for 2022. Check 2022 Top Rated Solar Incentives in Colorado. Government created the solar investment tax credit in 2006 to promote renewable energy growth.

Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit. When the solar tax credit ITC was passed in 2005 it was initially set to expire within two years by the end of 2007. Companies may receive 22 back on their panel purchases until 2030.

If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system. Your federal tax credit. As an electric customer you are eligible for a 010 per watt rebate.

Cost of Installation X 30 Tax Credit. Colorado does not offer state solar tax credits. Established by The Energy Policy Act of 2005 the federal tax credit for residential energy property initially applied to solar-electric systems solar water heating systems and fuel cells.

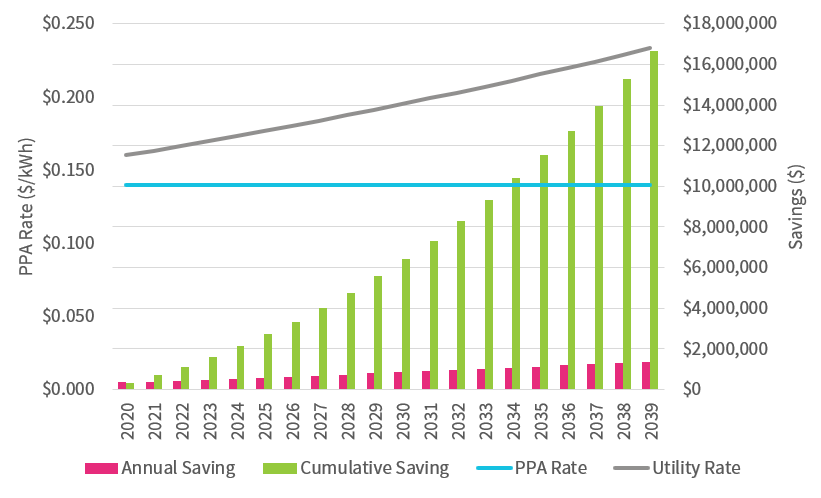

Many homeowners think they are not eligible for the solar tax credit because they dont have an additional tax bill at the end of the year. After 2024 corporations may receive 10 back on their solar system costs. This memorandum provides an overview of the financial incentives for solar power offered by utilities in Colorado as well as other incentives including net metering programs and state tax incentives.

Solar Property Tax Exemptions Explained Energysage

![]()

Solar Tax Credits 2020 Blue Raven Solar

Will The Solar Tax Credit Apply To Battery Storage Systems Cam Solar

Solar Panel Incentives Rebates Tax Credits A Definitive Guide

What Tax Deductions Can I Claim For Installing Solar Panels In Colorado

Time S Running Out Why Public Institutions Should Act Quickly To Maximize Solar Tax Credits Forefront Power

Federal Solar Tax Credit How It Works Explained In Plain English Sun Source Homes

What Do Solar Panels Cost Residential Solar Price Breakdown

How The Solar Tax Credit Makes Renewable Energy Affordable

Florida Solar Panels Florida Solar Company Adt Solar

How To Apply For A Rebate On Your Solar Panels Reenergizeco

When Does The Federal Solar Tax Credit Expire Iws

How Installing Solar Panels Can Help You Save On Your Taxes

Colorado Solar Incentives Colorado Solar Rebates Tax Credits

Tax Credits Archives Ion Solar

Solar Tax Credit 2021 Extension What You Need To Know Energysage

Solar Is It Worth It Living Colorado Springs